Big Picture

BIG Picture updated 815pm, Sunday, May 12

Monday, May 13th – Tuesday, May 21st

Periods of potentially high-impact, stormy weather through the weekend…

A surface level disturbance presided over the islands during the weekend, leading to light (5-15mph) E-ESE flow and afternoon sea breezes. There were also pockets of heavy rain. The flow should remain light and turn SE-ESE on Monday. Models depict a rather powerful Kona low beginning to develop on Tuesday. The flow should veer South at very light paces (5-10mph) with widespread afternoon sea breezes. Moderate to fresh (10-20mph+) SW winds will take over on Wednesday as the Kona low deepens to below 1000 millibars roughly 600 nautical miles North of the state. It could become light and variable again on Thursday as a surface convergent boundary pushes over the Big Island. The wind forecast becomes less uncertain for Friday and beyond as global weather models diverge. The GFS model brings the boundary westward and therefore moderate S-SE flow for Friday and the weekend. The ECMWF model keeps one more day of light and variable winds for Friday and then brings the boundary westward, leading to moderate S-SE flow for the weekend. E-ESE trade wind flow should return early next week as the storm weakens and tracks away from Hawaii.

Persistent, convective showers should continue into the week. By Wednesday or Thursday, increasing convergent flow and lift should enhance precipitation across the region. Things could get rather dicey by Friday and the weekend with increasing potential for significant rain and thunderstorms as dewpoints climb into the 70’s. The weather should improve significantly by early next week.

Surf Outlook –

North and West Shores: Small to start but sizeable late season surf likely after midweek…

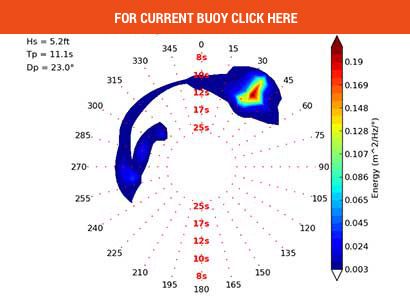

Recent/Now/Next: Surf on Sunday was 1-3’ Hawaiian scale on a slowly dropping 8 second North swell. The source was a short fetch of 25-30mph winds associated with a shortwave trough passing 1,200nm North of the islands May 8. Surf from this source should drop to 1-2’ on Monday. 18 second forerunners of a larger NNW swell arrived Sunday afternoon. The source of this larger swell was generated by a broad storm that tracked eastward over the Aleutian Islands May 9-10. The highest fetch winds reached 45-55mph, and significant wave heights rose to nearly 28’, which is larger than modelled. Surf should rise to and peak at 2-4’ on Monday. It should drop to 2-3’ on Tuesday.

Next: A compact storm quickly followed behind the larger system on May 10 and aimed a short fetch of 35-45mph winds at the islands. Moderate period forerunners of 15-16 seconds from the NW-NNW should arrive midday Tuesday. Surf should rise to 1-2’+ before dusk and peak Wednesday at 2-3’.

Next (MODERATE): The aforementioned Kona low will be in a position to aim a fetch of 30-45mph winds from just 800nm away. Proximity will enhance surf potential. Energy in the 9-12 second period band should increase sharply early Thursday. Surf should rise rapidly from 2-4’ at dawn to 4-6’ by the afternoon and hold into Friday morning, well above the May average. Surf should drop to 3-5’ Friday afternoon and 2-3’ early Saturday.

Finally: Models depict a large storm mostly confined to the Bering Sea May 13-14. A small portion of its Hawaii-directed fetch of 30-40mph winds could reach into the NW corner of the North Pacific. It could bring 1-2’ surf from the NW-NNW for the weekend and early next week.

Outlook: Things look to become very quiet for the last 2/3 of May. Climatology favors ridging over the western North Pacific, which would cut off the mid-latitude storm track. All eyes then turn to the early typhoon season for recurving tracks that could bring WNW-NW swells.

South and West Shores: Largest surf of the year so far incoming but paired with unfavorable wind…

Recent/Now: Surf on Sunday was 1-2’ occ. 3’ from a slowly dropping, 14-second period SSW swell. The source was a large cyclonic gyre SE of New Zealand that directed a long, wide fetch of 40-50mph winds to the NE May 2-3. It peaked locally last Friday at 3-4’ occ. 5’ at the top spots. Surf should drop to 1-2’ occ. + on Monday and 1-occ. 2’ on Tuesday.

Next: A series of storm-force systems passed south of the Tasman Sea May 6-8 and generated seas of over 40’. Very long period forerunners of 19-21 seconds from the SW-SSW should arrive overnight Monday. Surf should rise to 1-2’ occ. + early Tuesday with inconsistent 3’ sets likely in the afternoon. It should peak above the summer average at 2-3’ occ. + on Wednesday.

Next (MODERATE TO LARGE): One of these large systems passing south of the Tasman Sea maintained storm-force intensity as it moved SE of New Zealand May 8-9. Extreme winds to near hurricane-force (55-70mph) with good aim at Hawaii were measured. On May 9-10, a large subtropical storm passed NE of New Zealand and acted to extend the fetch to the SW. This resulted in an effective fetch length of 2,400nm. Validation from the American Samoa buoy today would have provided a critical sneak-peak at the incoming SSW, but the buoy is offline. The PacIOOS nearshore model predicted nearly 10’ of swell passing through the island nation on Sunday, and the JASON-3 altimeter measured 9-10’ seas Sunday afternoon. Extra-long period forerunners of 21-23 seconds from the SSW should arrive overnight Tuesday. Surf should rise to 1-2’ occ. 3’ on Wednesday, likely still smaller than the preceding SW-SSW swell. This SSW swell should become dominant by the afternoon as surf rises to 2-3’ occ. 4’. Heights should reach 3-4’ occ. + early Thursday and 3-4’ occ. 5’ by the afternoon. It should peak Friday and early Saturday at 3-5’ occ. + as the largest event of the year so far.

Finally (MODERATE): The system set up additional storm-force pulses well SE of New Zealand May 11-12. This should keep 3-4’ occ. 5’ surf from the SSW-S going Sunday and early Monday. Surf should drop to 2-3’ occ. 4’ late Monday and 1-2’ occ. 3’ on Tuesday.

Also: A Kona low will generate southerly wind chop of 1-2’+ in the 5-7 second period band Thursday through Saturday.

Outlook: The South Pacific will cool off significantly as high pressure builds east of New Zealand and lead to weak storm activity. Generally small surf from the SW-SSW should prevail for the final week of the month with peaks to around the summer background to small levels (1-2’ occ. +).

East Shores: Small surf this period…

Recent/Now/Next: Surf on Sunday was 1-2’+ from a mix of North swell and small ENE trade wind swell. Surf should be similar on Monday as the trade wind swell holds but will drop to 1-2’ on Tuesday as the trade wind flow immediately upstream of the islands weakens. Surf from this source should be less than 2’ through Thursday. Stronger upstream trades could bring surf back up to 1-2’ Friday into early next week.

Finally: Strong NE winds of 30-35mph blew offshore around the CA/OR border May 8-9. It should bring an 8-10 second NE ground swell arriving Monday, May 13. Surf could peak at 1-2’ on Tuesday.

Outlook: There is moderate confidence that a stronger and lengthier fetch of trades upstream of Hawaii could bring near average surf of 1-3’ by the middle of next week and through the rest of the month. Disturbances near the state should keep the local winds lighter and better-than-normal wind conditions.

The next full SNN Big Picture will be issued on Sunday, May 19.

Forecaster Jonathan Huynh

Surf Climatology HERE